The number of working Americans age 65 and older dropped by 1.1 million during the first three months of the pandemic and has been slower to recover than other age groups. Even so, more than 10.8 million workers are eligible for Medicare, and the number is likely to grow as 10,000 baby boomers turn 65 every day until 2030.1–2

Some employers — especially small businesses — may require employees or covered spouses to enroll in Medicare when they are eligible in order to retain their employer-sponsored health insurance. But many workers who are eligible for both types of coverage can choose one or the other, or both. To make an informed decision, it’s important to understand an array of rules and other considerations regarding costs and coverage.

Primary Insurance vs. Secondary Insurance

If an employer has 20 or more employees, the employer health coverage is primary and would pay first for covered expenses. Medicare is secondary and may pay for some expenses not covered by the employer coverage. Employers with 20 or more employees must offer the same health insurance benefits to employees age 65 and older that are offered to younger workers. The same is true of spousal benefits, if offered.

If an employer has fewer than 20 employees (and is not part of a multi-employer group for health insurance), Medicare would be primary and the employer coverage would be secondary, which is why small businesses may require eligible employees or spouses to enroll in Medicare in order to have employer-sponsored coverage.

Ask your employer if you have questions about your coverage at age 65.

Part A Hospital Insurance and HSAs

Medicare Part A helps pay for inpatient hospital care as well as some skilled nursing facility, hospice, and home health care. Because it is free for most people, consider enrolling in Part A even if you have employer coverage. It could be helpful to have both types of insurance to fill any coverage gaps. However, if you have to pay for Part A, you may want to wait before enrolling.

If you have a high-deductible health plan through work, keep in mind that you cannot contribute to a health savings account (HSA) after you enroll in Medicare. The HSA is yours, even if you can no longer contribute to it, and you can use the tax-advantaged funds to pay Medicare premiums, along with other qualified medical expenses. So it might be helpful to build your HSA balance before enrolling in Medicare.

Whether you should opt out of premium-free Part A in order to contribute to an HSA depends on what you consider to be more valuable: secondary hospital insurance coverage or tax-advantaged contributions. HSA funds can be withdrawn free of federal income tax and penalties provided the money is spent on qualified health-care expenses. HSA contributions and earnings may or may not be subject to state taxes.

If you claim Social Security benefits, regardless of your work status, you will be enrolled automatically in Part A and will not be able to contribute to an HSA.

Part B and Part D

Medicare Part B medical insurance, which helps pay for physician and outpatient expenses, requires premium payments, so it would be wise to compare the costs and benefits of Medicare to your employer’s plan. If you’re satisfied with your employer coverage, you can generally wait to enroll in Part B. The same is true of Medicare Part D, which helps pay for prescription drug costs.

Working After 65

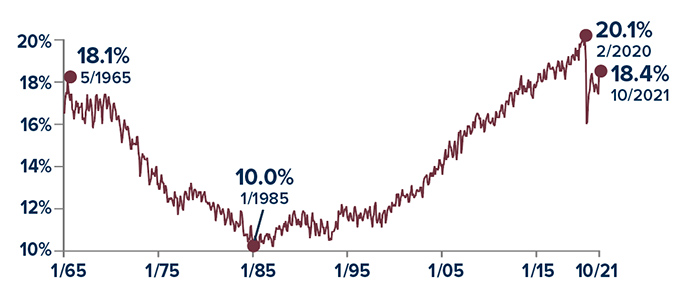

The percentage of working Americans age 65 and older decreased steadily after Medicare was signed into law in July 1965 and began to rise again in 1985, due to a variety of factors, including the decline of traditional pensions, more knowledge-based jobs, and longer lifespans. The percentage dropped sharply in the early months of the pandemic, and it remains to be seen whether it will return to its pre-pandemic high.

Source: U.S. Bureau of Labor Statistics, 2021

Enrollment Periods and Penalties

You can enroll in premium-free Medicare Part A without a penalty any time after you become eligible. However, late-enrollment penalties may apply if you do not enroll in premium-based Part A and Part B — or a Medicare Advantage Plan in lieu of Parts A and B — when you are first eligible. These penalties do not apply if you are covered by employer-sponsored health insurance, as long as you enroll within eight months after the last day of employment, regardless of when the employer-sponsored coverage ends.

You can enroll in a Part D prescription drug plan during the two full months after your employer-sponsored coverage ends as long as it is “creditable prescription drug coverage.” Most employer plans are considered creditable. If you do not enroll during this two-month period, you will have to wait until the open enrollment period from October 15 to December 7 each year.

Medicare rules are complex, and these are only guidelines. For more detailed information, visit medicare.gov.

Reposted from marktoney.com

No comments:

Post a Comment